|

Important Hints

1.)

High Reliability

: It is always our top priority to keep investors' assets safe when we develop an investment plan for our clients. With this concern in mind, we have chosen the insurer that have been in business over 170 years, and grade rating of their pension products are "Exceptionally Strong" (by Moody's AAA and by Standard & Poor's AA+). A main reason why received so good rating on pension plans, with long-term cumulated high quality assets and reliable investment resources, the insurer have been keeping over 80% of its pension business with federal government and major banks in the US. It is with this protection that the insurer can keep the cash value of its whole life insurance at 5%-10% annual growth, while never participating in the stock market.

2.)

Funding Resources

: For investors' money resource, our only requirement is that all funds to be input into an investment plan should be transferred from banks or bank checks. In other words, we do NOT ask how and where an investor got these funds before. We strictly protect the privacy of our customers.

3.)

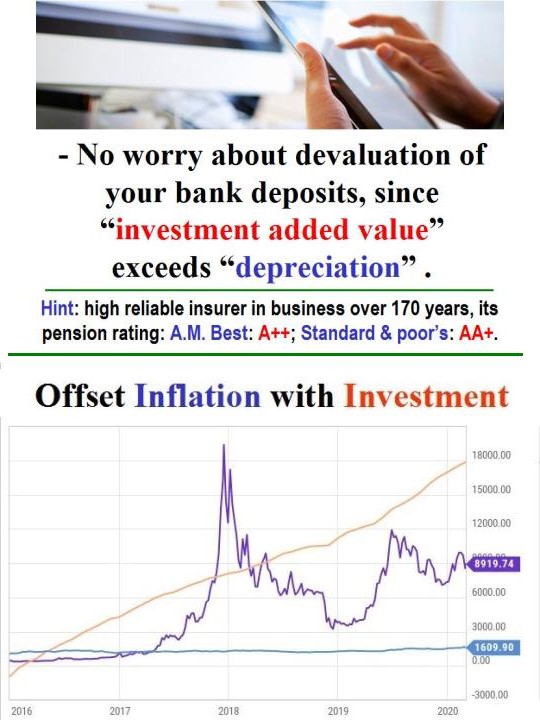

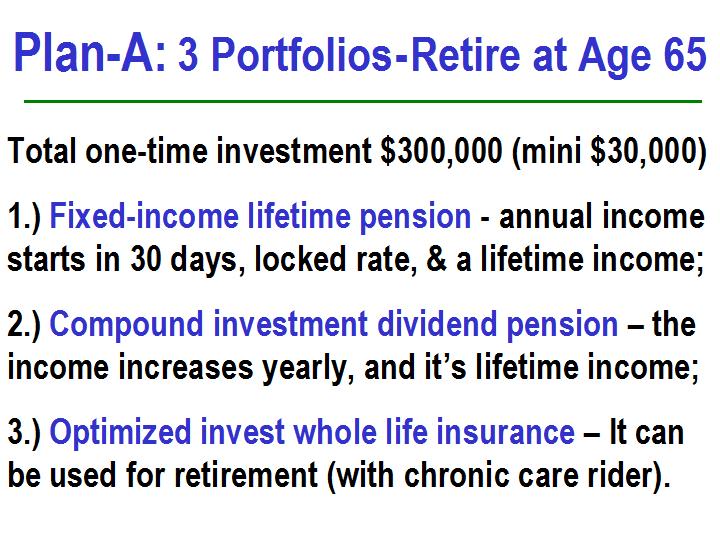

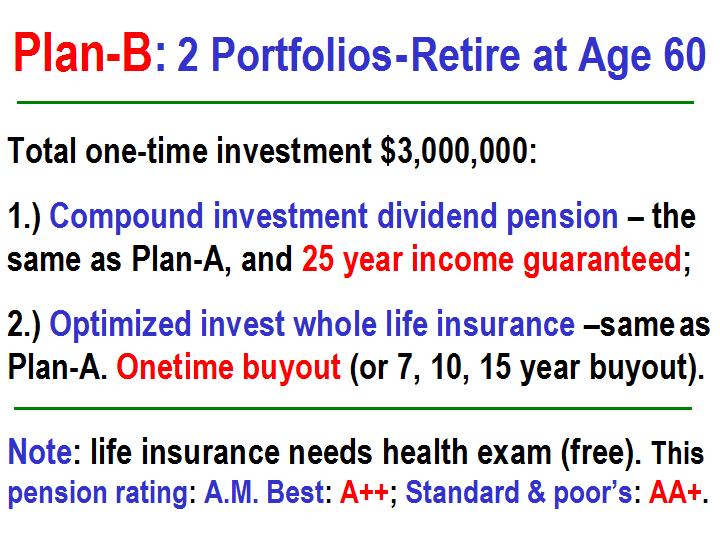

Customized Plan

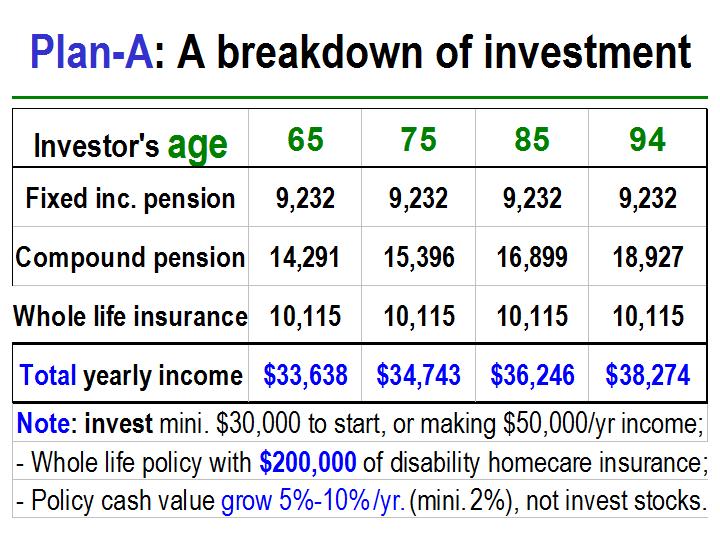

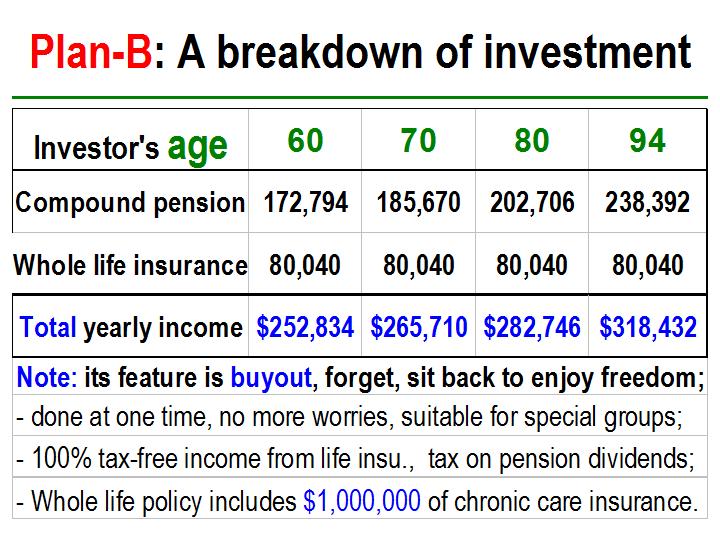

: The attached two schemes (see attachment) can effectively offset the risk of inflation and prevent the devaluation of bank deposits. We can also adjust the above investment plans (recombining product formulations, optimizing capital allocation ratio, choosing the right time to cash out investments, etc.) according to the requirements of investors and actual financial conditions, so that our investment plans are more in line with the specific needs of investors . For this reason, we suggest that investors should provide their specific financial situation and investment needs as much as possible when they come to consult, so that when we formulate plans, we can find the right direction and make our plans more popular with investors.

For more inquiries, or to get a quote, please call Henry Hu at 503-693-2423, email: hwu475@gmail.com, my website: www.HenryHuAgency.com

|